Have you ever found yourself struggling with your finances and wondering how to get back on track? Perhaps unexpected expenses, job loss, or mounting debts have made it hard to see a way out. Financial setbacks can feel overwhelming, but the good news is that recovery is possible.

If you’re feeling lost or unsure about how to manage your finances, don’t worry. There are clear steps to know what to do if you get a summons for credit card debt to improve your financial situation. In this article, we explore 10 key steps to help you get back on track through financial recovery.

No. 1

Assess Your Current Financial Situation

The first step in financial recovery is to understand where you currently stand. Before you can begin managing your finances, you need to know what you’re working with. Make a list of all your monthly expenses, such as rent, utilities, food, and transportation.

Be honest with yourself about where your money is going, and make sure you don’t overlook anything, even small expenses. In Texas, where living costs can vary, knowing your financial situation is especially important for making smart decisions.

Identifying financial concerns, like high-interest debts or unnecessary spending, is the first step in a financial assessment. If you’re disputing any debts, understanding how a debt validation letter texas can ensure the debts listed against you are accurate. This can help you move forward with a plan.

No. 2

Create a Realistic Budget

A budget is the foundation of any financial recovery plan. It helps you track your income and manage your expenses. A good budget will help you see where your money is going and where you can make changes.

From there, decide how much you can allocate toward savings, debt repayment, and other goals. Be sure to keep your budget realistic and flexible.

If your income changes or unexpected expenses pop up, be prepared to adjust accordingly. With a solid budget, you’ll be able to control your spending and focus on the most important areas of financial recovery.

No. 3

Cut Unnecessary Expenses

Once you have a budget, it’s time to look at your spending habits. Cutting unnecessary expenses is one of the quickest ways to improve your financial situation.

Review your spending and ask yourself: Are there things I can live without? This might mean canceling subscriptions, eating out less, or finding cheaper alternatives for daily necessities.

One way to identify unnecessary expenses is to track your spending for a month. This will help you see where your money is going and where you can make cuts.

Be honest with yourself about your habits, and try to cut back on things that aren’t essential. Every dollar you save is a dollar that can go toward your financial recovery.

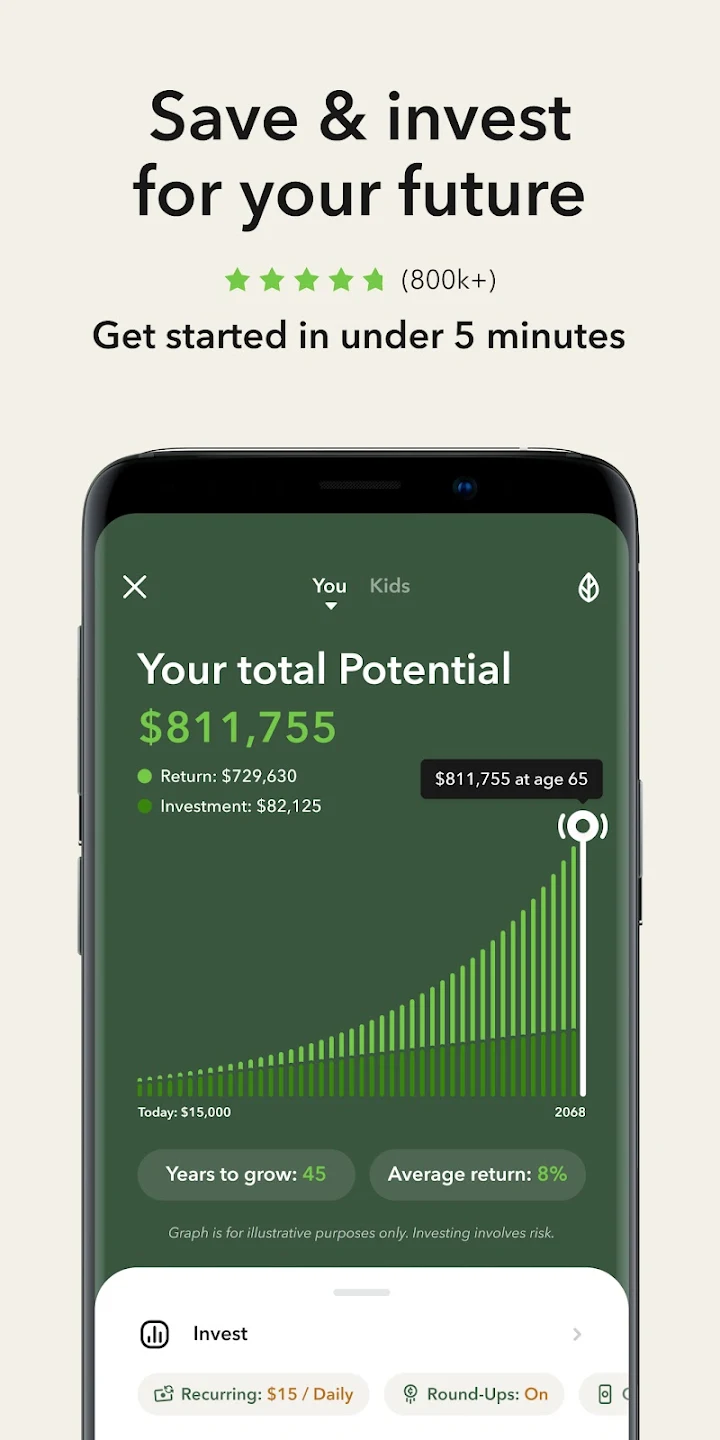

Acorns

Start building your future today with Acorns. Save, invest, build your emergency fund, and watch your money grow effortlessly.

Sign up now and get a $5 investment as a first step toward financial freedom!

No. 4

Prioritize Debt Repayment

If you have debts, prioritizing repayment is crucial to getting back on track. Start by focusing on the debts with the highest interest rates, such as credit cards. Once you’ve tackled high-interest debt, move on to other obligations, such as student loans or personal loans.

A successful approach to answer debt collection lawsuits includes using the debt snowball method to eliminate small accounts first and then tackle larger balances. Using this strategy will help you experience positive progress, which stimulates greater determination to stick with it.

No. 5

Build an Emergency Fund

Your financial recovery needs an emergency fund to operate as a vital component. An emergency fund serves as a safety net that safeguards you from unforeseen costs, which might include medical expenses, automobile maintenance, or loss of employment.

Make your emergency fund grow to three to six months’ worth of living expenses before you consider it complete. Setting smaller, achievable targets serves as a good starting step for those who find a substantial fund requirement too challenging.

No. 6

Improve Your Credit Score

Your financial recovery depends heavily on your current credit score position. Higher credit scores make it possible to obtain premium loan interest rates as well as apartment leases and job positions. A better credit score requires timely payments on all your bills, together with a commitment to never miss any payments.

Regular inspection of your credit report helps you identify any reporting mistakes. Report any incorrect items to the credit bureaus for verification. A positive credit score provides better access to financial possibilities, so follow proven measures to enhance it.

No. 7

Explore Additional Income Sources

Sometimes, it’s not enough to cut back on expenses—you may also need to find additional ways to bring in money. If possible, look for extra income opportunities that fit your skills or interests.

You could take on a part-time job, do freelance work, or start a side hustle. Even small amounts of extra income can make a significant impact on your financial recovery.

No. 8

Seek Professional Help if Needed

If your financial situation feels too overwhelming, consider reaching out to a financial professional. Financial advisors or credit counselors can offer expert advice and guide you on knowing if debt collectors can sue you in Texas. They can help you create a personalized plan to manage your debts, invest wisely, and build savings.

If you’re struggling with a debt validation letter in Texas, a credit counselor can help you negotiate with creditors and set up manageable repayment plans. Seeking help doesn’t mean you’re failing—it means you’re taking a proactive step toward regaining control of your finances.

No. 9

Stay Focused on Your Goals

Recovery won’t happen overnight. It’s essential to stay focused on your long-term financial goals. Whether that’s paying off debt, saving for retirement, or buying a home, having clear goals can help you stay motivated.

Tracking your progress can also keep you accountable. Every time you reach a milestone, whether it’s paying off a credit card or building a bigger emergency fund, take a moment to acknowledge your success.

No. 10

Be Patient and Consistent

Lastly, remember that financial recovery is a process. It won’t happen overnight, but with patience and consistent effort, you’ll get there.

There will be challenges along the way, but don’t let them discourage you. Keep making smart choices, stick to your plan, and stay focused on your long-term goals.

Every step you take brings you closer to financial freedom.

Takeaways

Recovering from a financial setback isn’t easy, but it is possible. By assessing your situation, creating a plan, and taking consistent action, you can regain control and build a more secure future.

Whether you’re dealing with debt, rebuilding your credit, or simply trying to make ends meet, these steps will guide you in the right direction. Take it one day at a time—and remember, progress is progress, no matter how small.

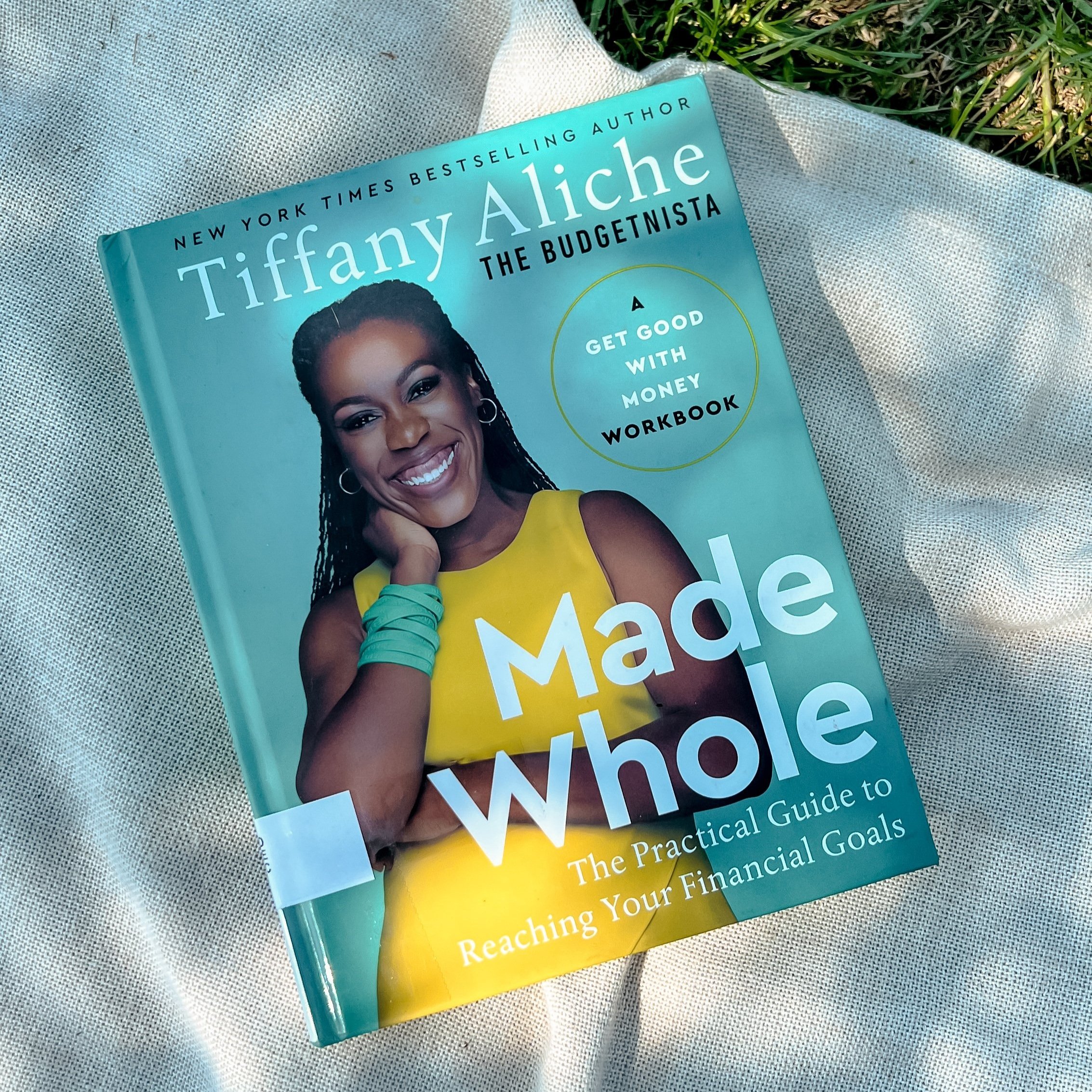

Looking for resources?

At Hello Lovely Living, we aim to empower you to earn and save money and time while benefiting from our expansive network of home, life, wellness, travel, work-from-home, career, and business resources and opportunities. Discover a wealth of tools to support your journey.